"Dr. Zoidberg - RIP Oppo" (thetomselleck)

"Dr. Zoidberg - RIP Oppo" (thetomselleck)

02/12/2018 at 00:45 ē Filed to: Turbo Tax is king and H&R Block can kiss my ass

5

5

35

35

"Dr. Zoidberg - RIP Oppo" (thetomselleck)

"Dr. Zoidberg - RIP Oppo" (thetomselleck)

02/12/2018 at 00:45 ē Filed to: Turbo Tax is king and H&R Block can kiss my ass |  5 5

|  35 35 |

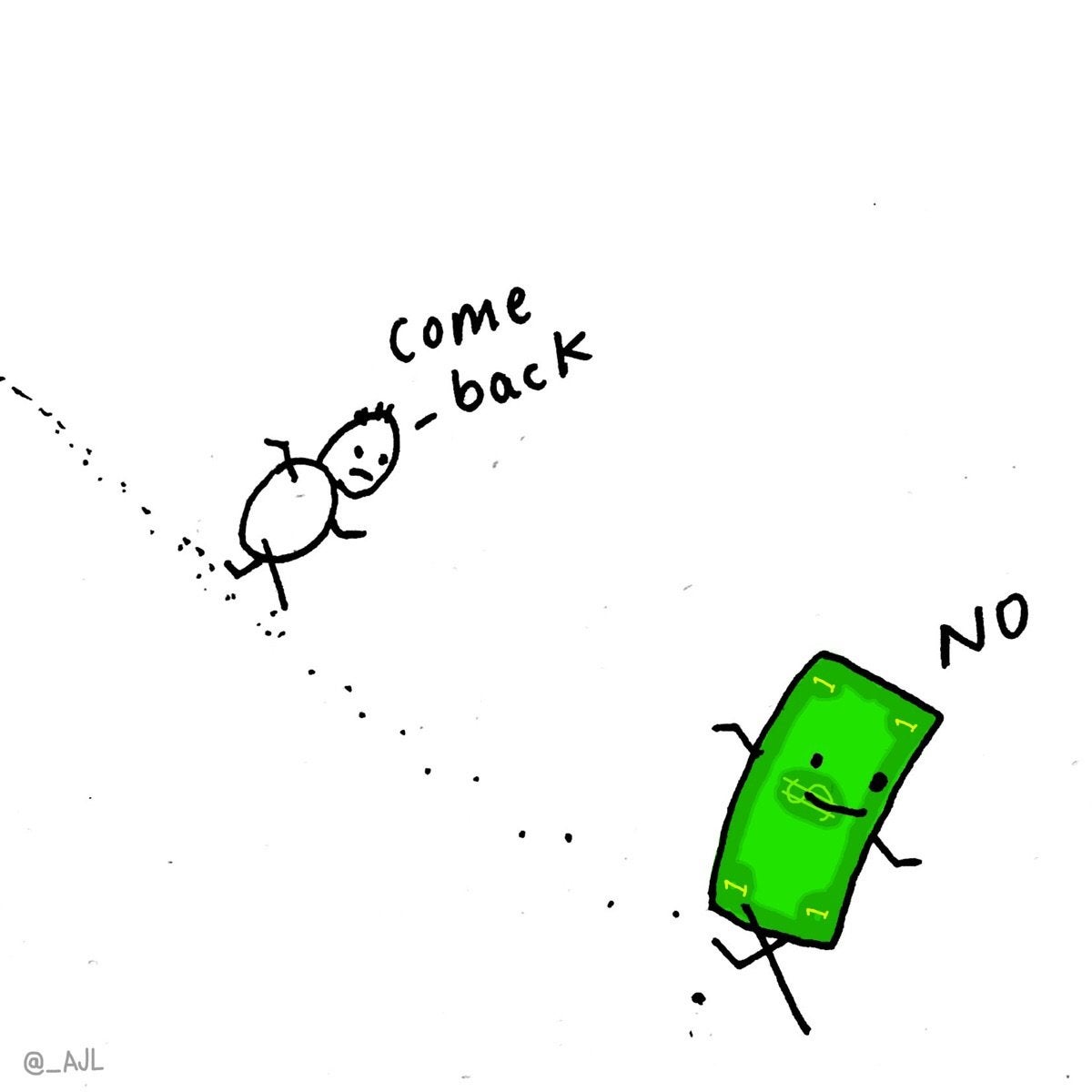

Expect me to throw caution to the wind. Itís time to make it rain, as the kids say. Ahhh, no itís going right into my savings account like I do every year. But still!

pip bip - choose Corrour

> Dr. Zoidberg - RIP Oppo

pip bip - choose Corrour

> Dr. Zoidberg - RIP Oppo

02/12/2018 at 00:50 |

|

Still yet to do mine for 16/17 tax year

The Crazy Kanuck; RIP Oppositelock

> Dr. Zoidberg - RIP Oppo

The Crazy Kanuck; RIP Oppositelock

> Dr. Zoidberg - RIP Oppo

02/12/2018 at 00:53 |

|

Mines going pay down the car loan & pay off some school debt. I hate being reasonable.

Nick Has an Exocet

> Dr. Zoidberg - RIP Oppo

Nick Has an Exocet

> Dr. Zoidberg - RIP Oppo

02/12/2018 at 00:55 |

|

Iím not looking forward to it. Maybe Iíll do it next weekend. Last year, TaxAct gave me some great statistic about how Iím in the top 8% of most butt-raped americans by percentage. The tax professional advice to me? Stop living in California, you idiot.

As an aside: I donít feel in the top 8% of Americans. Unless our top 8% also happen to live in areas with gun violence, have roommates, and eat tofu because itís a cheaper protein than chicken.

BlueMazda2 - Blesses the rains down in Africa, Purveyor of BMW Individual Arctic Metallic, Merci Twingo

> Dr. Zoidberg - RIP Oppo

BlueMazda2 - Blesses the rains down in Africa, Purveyor of BMW Individual Arctic Metallic, Merci Twingo

> Dr. Zoidberg - RIP Oppo

02/12/2018 at 01:11 |

|

So are you getting more chicken parm with the mon...wait...thatís Party-viís thing.

More chew toys and treats for Luna it is!

CarsofFortLangley - Oppo Forever

> Dr. Zoidberg - RIP Oppo

CarsofFortLangley - Oppo Forever

> Dr. Zoidberg - RIP Oppo

02/12/2018 at 01:32 |

|

Whatís a ďsavings accountĒ?

My bird IS the word

> Dr. Zoidberg - RIP Oppo

My bird IS the word

> Dr. Zoidberg - RIP Oppo

02/12/2018 at 01:46 |

|

I didnít make enough to get taxed this year.... so I am getting back my full return of 800$. Going straight towards my engine rebuild.

Eric @ opposite-lock.com

> Dr. Zoidberg - RIP Oppo

Eric @ opposite-lock.com

> Dr. Zoidberg - RIP Oppo

02/12/2018 at 01:49 |

|

Glad to see Iím not the only square that puts returns into savings. Still need to do ours and worried that we might owe...

Did that new tax bill take effect immediately or is mortgage interest still a thing?

Dr. Zoidberg - RIP Oppo

> Eric @ opposite-lock.com

Dr. Zoidberg - RIP Oppo

> Eric @ opposite-lock.com

02/12/2018 at 01:57 |

|

Iím not sure. It did tell my that my mortgage interest didnít affect anything though because reasons. That said, my return was a little bit higher than last year.

AMGtech - now with more recalls!

> Dr. Zoidberg - RIP Oppo

AMGtech - now with more recalls!

> Dr. Zoidberg - RIP Oppo

02/12/2018 at 02:02 |

|

Started. H&R block online says Iím going to owe 1900. Only 3 exemptions. What in the actual fuck.

Dr. Zoidberg - RIP Oppo

> AMGtech - now with more recalls!

Dr. Zoidberg - RIP Oppo

> AMGtech - now with more recalls!

02/12/2018 at 02:08 |

|

Use Turbo Tax.

Dr. Zoidberg - RIP Oppo

> CarsofFortLangley - Oppo Forever

Dr. Zoidberg - RIP Oppo

> CarsofFortLangley - Oppo Forever

02/12/2018 at 02:09 |

|

Itís the thing you can have when the nicest car you own is 16 years old.

AMGtech - now with more recalls!

> Dr. Zoidberg - RIP Oppo

AMGtech - now with more recalls!

> Dr. Zoidberg - RIP Oppo

02/12/2018 at 02:18 |

|

Is there really that big of a difference though?

Dr. Zoidberg - RIP Oppo

> AMGtech - now with more recalls!

Dr. Zoidberg - RIP Oppo

> AMGtech - now with more recalls!

02/12/2018 at 02:23 |

|

I canít say because I didnít use themonline. What I will say is I used their in-office services where they took almost $400 for their ďworkĒ and I found out later they were not thorough... The interest on our student loans alone doubled our return that H&R Block had got us. In addition, we had other interest that we could claim. The TurboTax program cost 40 bucks and was exhaustive and got me fat returns (comparatively speaking).

AMGtech - now with more recalls!

> Dr. Zoidberg - RIP Oppo

AMGtech - now with more recalls!

> Dr. Zoidberg - RIP Oppo

02/12/2018 at 02:32 |

|

Iíll look into it. Thanks.

pip bip - choose Corrour

> AMGtech - now with more recalls!

pip bip - choose Corrour

> AMGtech - now with more recalls!

02/12/2018 at 02:46 |

|

ďH&R BlockĒ thereís your problem

AMGtech - now with more recalls!

> pip bip - choose Corrour

AMGtech - now with more recalls!

> pip bip - choose Corrour

02/12/2018 at 02:52 |

|

Never claimed to be a financial expert!

AestheticsInMotion

> AMGtech - now with more recalls!

AestheticsInMotion

> AMGtech - now with more recalls!

02/12/2018 at 03:07 |

|

Another vote for TurboTax. Iíve tried a few different programs and TT has been the best for me

Steve in Manhattan

> Dr. Zoidberg - RIP Oppo

Steve in Manhattan

> Dr. Zoidberg - RIP Oppo

02/12/2018 at 03:21 |

|

NY refund $141, but then 2014 recalculation based on federal change meant I owe NY $147 ... so Iím six bucks down.

random001

> AMGtech - now with more recalls!

random001

> AMGtech - now with more recalls!

02/12/2018 at 06:16 |

|

Same, Iíve been using TurboTax for years. Itís gotten much better, but itís always been great for my refunds.

Kiltedpadre

> AMGtech - now with more recalls!

Kiltedpadre

> AMGtech - now with more recalls!

02/12/2018 at 07:00 |

|

I second this. I used the H&R Block software five years ago. After cutting and pasting the text of three deductions I was eligible for that their ďtax professionalsĒ didnít know about I switched to TurboTax and got a much larger refund.

CB

> Dr. Zoidberg - RIP Oppo

CB

> Dr. Zoidberg - RIP Oppo

02/12/2018 at 08:02 |

|

Unfortunately, I donít get all my paperwork until about a week before taxes are due, otherwise Iíd try to be done them by now.

DAWRX - The Herb Strikes Back

> Dr. Zoidberg - RIP Oppo

DAWRX - The Herb Strikes Back

> Dr. Zoidberg - RIP Oppo

02/12/2018 at 08:29 |

|

BKosher84

> AMGtech - now with more recalls!

BKosher84

> AMGtech - now with more recalls!

02/12/2018 at 08:49 |

|

Spend 250 bucks and have a independent tax professional do your taxes, trust me itís worth it. One time we forgot that my wife and I cashed in savings bonds for a down payment on our house and when the IRS audited us three years later we got a tax bill for 4,000 dollars. That was the last time my wife and I did our taxes ourselves.

Future next gen S2000 owner

> Dr. Zoidberg - RIP Oppo

Future next gen S2000 owner

> Dr. Zoidberg - RIP Oppo

02/12/2018 at 09:22 |

|

Iím going to file twice this year, sort of. Iím going to use TurboTax or some online software and get them done in person at H&R. We shall see who is the victor.

Dr. Zoidberg - RIP Oppo

> Future next gen S2000 owner

Dr. Zoidberg - RIP Oppo

> Future next gen S2000 owner

02/12/2018 at 09:26 |

|

Youíll regret the latter part of your plan, but I look forward to your findings nonetheless.

Future next gen S2000 owner

> Dr. Zoidberg - RIP Oppo

Future next gen S2000 owner

> Dr. Zoidberg - RIP Oppo

02/12/2018 at 09:32 |

|

After a couple years of several hundred dollars return fees, Iím beginning to regret the latter part of my plan as well.

Mid Engine

> Dr. Zoidberg - RIP Oppo

Mid Engine

> Dr. Zoidberg - RIP Oppo

02/12/2018 at 10:08 |

|

My wife did ours, heads up if youíre using TurboTax, at the very beginning they ask for your phone number. Make sure you enter it, otherwise you canít efile. Getting $4700 back, which will be applied to my sonís student loans.

AMGtech - now with more recalls!

> BKosher84

AMGtech - now with more recalls!

> BKosher84

02/12/2018 at 10:20 |

|

This is what I was thinking when I saw the blockís outcome. Might plug my stuff into turbo tax first and see what it says.

CarsofFortLangley - Oppo Forever

> Dr. Zoidberg - RIP Oppo

CarsofFortLangley - Oppo Forever

> Dr. Zoidberg - RIP Oppo

02/12/2018 at 10:59 |

|

Touche

AddictedToM3s - Drives a GC

> Dr. Zoidberg - RIP Oppo

AddictedToM3s - Drives a GC

> Dr. Zoidberg - RIP Oppo

02/12/2018 at 11:56 |

|

I hear that. My tax return is going straight to pay off my credit card. On the bright side that means Iíve paid off my credit cards.

CaptDale - is secretly British

> Dr. Zoidberg - RIP Oppo

CaptDale - is secretly British

> Dr. Zoidberg - RIP Oppo

02/12/2018 at 12:15 |

|

I got my refund a week ago.... Half is already gone and the other half soon on something very Oppo

Dr. Zoidberg - RIP Oppo

> CaptDale - is secretly British

Dr. Zoidberg - RIP Oppo

> CaptDale - is secretly British

02/12/2018 at 13:39 |

|

Nice

CaptDale - is secretly British

> Dr. Zoidberg - RIP Oppo

CaptDale - is secretly British

> Dr. Zoidberg - RIP Oppo

02/12/2018 at 13:58 |

|

I agree

190octane

> Dr. Zoidberg - RIP Oppo

190octane

> Dr. Zoidberg - RIP Oppo

02/12/2018 at 15:31 |

|

Lol, tax refund? Whatís that?

jminer

> Dr. Zoidberg - RIP Oppo

jminer

> Dr. Zoidberg - RIP Oppo

02/12/2018 at 22:59 |

|

Man, the car market from the Seattle area gives me a bad case of the must-haves. I like in STL, int the rust belt and the cheap nearly rust-free cars at low prices make me want to buy a one way plane ticket, find something on CL and bring it home with me...